Zoho Books is online accounting software that will assist you to stay on top of your cash flow and run your accounts online. You can use a free 14 days...

View ProfileBest GST Software in India 2023

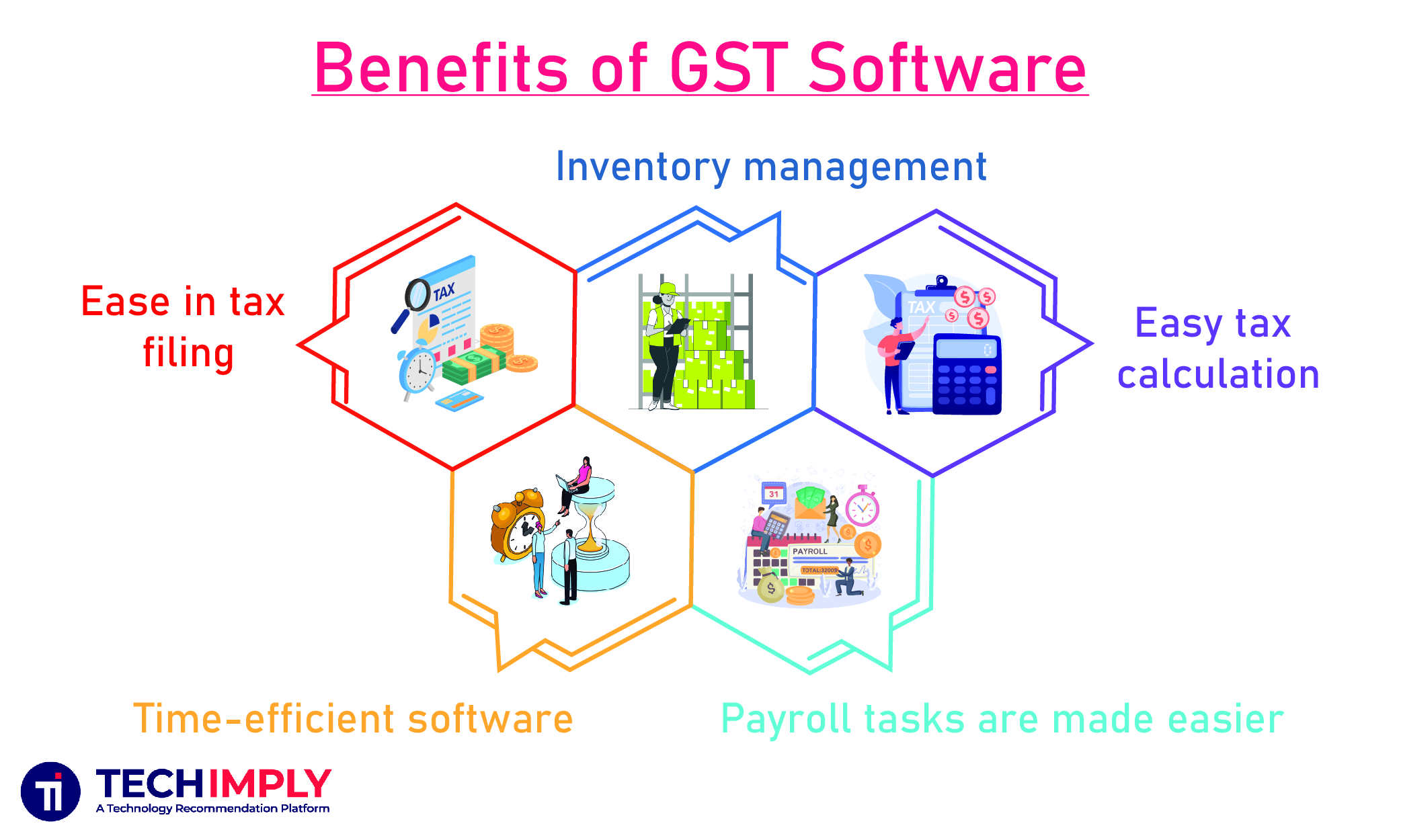

For any business in India, it is not possible to carry out with GST, and making all the process manually is also not an easy task. To overcome such issues, Techimply will help with the Best GST software in India which will help in various aspects of GST billing for your concern. Among a wide number of different software in the market, all are different from their perspective and they need a different company. The Best free GST software India thus provided will be after the complete analysis of your needs and make an efficient one for you. No more delays, reach us for the best software as soon as possible.

List of20 best GST Software in India for 2023 - Techimply

HostBooks, an automatic all-in-one accounting & compliance software provides you with a comprehensive platform for GST, TDS, eWay Bill Accounting, Tax & Payroll

View ProfileAlignBooks, India's top cloud-based accounting software, provides a comprehensive solution for MSMEs looking to optimize their business operations. It makes accounting, inventory management, and compliance functions easier in today's demanding...

View ProfileTally.ERP 9 is India’s leading business management software for GST, accounting, inventory, and payroll. It is economical and one of the most popular ERP software solutions available in the industry,...

View ProfileCaptainBiz is a simple to use software solution to manage your business hassle-free. Generate Invoices, track Inventory in real-time, manage Customers & Suppliers, monitor Cash & Bank Transactions, all in...

View ProfileMarg GST software is useful for every business i.e. retail, distribution, and manufacturing. It makes GST billing and filing, Generation of E-way bills for transportation business, invoices & 1000's of...

View ProfileVyapar is the simplest billing and invoice and accounting software. Vyapar is a user-friendly billing and invoice software. Most simple, secure & easy software.The main goal is to make a...

View ProfileHDPOS is one of the best accounting software. It is easy to use and has a nice interface. It is a Windows-based Billing, Inventory Management and Accounting Software and it...

View ProfileOne of the best Reach GST Accounting Software for Small and Medium Businesses. The GST Software is making taxation much easier and supports business owners in any type of business...

View ProfileBusy accounting software is simple and easy to provide billing and invoice software. Busy is simple accounting software that has everything you need to grow up your business.

View ProfileSpectrum billing software is the best software for business. It can assist business accounting and bill generation, Inventory management software, we can use it for bank details and for many...

View ProfileSleek Bill is one of the fastest billing and invoicing software solutions. It can be improved to generate the bill and invoice.

View ProfileBook Keeper is most simplified accounting solution for Android/iOS and Windows. It has easy and fast invoicing. It is GST/VAT ready. It has inventory management feature along with warehousing and...

View ProfileProfitBooks is the fastest growing & simple to access online accounting software. You can easily track your transactions and control your bank account details. It keeps tabs on your business...

View ProfileGiddh is an inventive tool crafted for undertaking accounts, invoicing, and other related activities. The Giddh is a great and powerful software for invoices and billing. With its beautiful templates...

View ProfileClearTax is providing a full-fledged solution and free trial of taxation with expert support and freelance for the business to guide how to save money and time. Income tax return...

View ProfileJust Billing Mobile is a unique billing app for micro, small-scale, and medium-sized businesses. It is an intuitive business solution, that does not require you to have any technical knowledge...

View ProfileProfitBooks is a simple and fastest business accounting software for small businesses. It lets you create beautiful invoices, track expenses and manage inventory without any accounting background.

View ProfileSaral GST solution is a complete and user-friendly return filing software to suit your diverse GST needs. Apart from return filing, we also have software for accounting, billing, and invoicing....

View ProfilePrimaseller inventory management software is compliant with GST norms. Manage your inventory, stores, orders, POS, B2B, purchase orders, accounts, and more with just one platform.

View Profile

Frequently Asked Questions (FAQs)

GST software is a tool that enables organizations to manage GST compliance and ensures that businesses adhere to mandatory regulations.

GST - Goods and Services Tax. It is an indirect tax that has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. Under the GST regime, the tax is levied at every point of sale. In the case of intra-state sales, Central GST and State GST are charged.

The Best GST software is:

- Tally

- Zoho books

- Marg GST software

- Vyapar - Accounting and Invoicing

- Reach GST

One of the most prominent GST features is the input tax credit. If a manufacturer or service provider has already paid input tax on a purchase, the same can be deducted from their total output tax liability. The input and output invoices need to match to take advantage of the tax credit.

GST is an indirect tax in lieu of tax on goods (excise) and tax on service (service tax). The GST is just like State level VAT which is levied as a tax on the sale of goods. GST will be a national-level value-added tax applicable to goods and services.

GST software that enhances your business in the GST era

The Best GST software India will help you in generating GST invoices and also in GST returns. When you have such GST software it will help you with inefficient accounting and also in tax management with the best possible features. In this modern GST era, GST has been associated with all businesses any type of business. The manual process needs huge resources and the cost is also so high. To avoid these issues you may choose the GST software and make use of them.

Makes the document management process easier

When speaking about the document management process there are lots of processes like warning notice, registration, payments, a refund of GST, etc all these can be easily digitalized and they can be carried out easily. On the whole, it is necessary to adopt this technique of billing for easy management of documents.

The factor of compliance

It is one of the important parts of these new GST reforms. There is some post-GST process like destination-based tax rules, the unveiling of the new GST tax structure, and multi-state conformity, most of the small and medium business people feel hard in these cases. With the right GST-integrated EPR software, it is easy to perform these tasks easily and this will help the company in meeting the new regulations including maintaining correct financial records.

Highly systematization

With the help of GST, it is easy to make the current undisciplined goods and service movement to be systematic. For this, it is necessary for the business to adopt the GST-ready ERP system and enjoy the pleasure of such a new systematic process.

Security of data been used

Security is the most important thing to be concentrated in this in the internet era. No matter what technique you use and how you save the data the hackers are smart enough in today’s world to hack your data. One of the best options will be choosing the web-based GST software to be wise enough in saving your data.

Flexibility is possible

All the business category people in small, medium, and large businesses are trying to adopt the ERP system to automate their business process in an efficient manner. Under such a situation, it is a highly critical issue to establish completely all the new master data in certain GST software. Therefore, the GST software will be to right choice to integrate with the prevailing system to offer a seamless experience.

Artificial intelligence is another key to reduce the complexity

Even though GST offers a unified tax system, there is some process to make the system complex. In India, the taxpayers who have registered in one state will need to file tax in 37 returns in one financial year. Nowadays it is found that most people have global partners and some network all over India. For example, if the company has branches it will need to pay 37*29-1073 tax returns just for one financial year. This is the key reason to have the GST software.

Things to consider when you own GST software

Price: The cost is an important factor that you should consider when buying GST software. The cost that you spend is the efficiency of the software. Look for the features that are available in GST software and compare with the features that are required for you in your business, based on these you may choose the software.

Accessibility: This completely depends on your personal requirements, decide when you feel convenient to use the GST software online or on your laptop or desktop, or on mobile. Based on the factor you may choose them.

Security: It is the most important feature that you should take care of. If the GST software does not provide proper security in the data that you store there is no use in using the software. Take intense care of the security provided by the software.

Complexity: The process of GST is already a complex system that does not make the GST software even more complex. Make sure you have a proper demo on the system and also on the system and also on the way they have to be used in case if there are any issues in the software.

Support: For any product that you buy, it is important to have proper support from the professional in case if there are any issues in handling the GST software. The vendor that you buy the software from should be responsible enough to respond to you at any time that you contact them.

There are lots of companies that provide the GST software with the features that you ask but not all of them completely trustworthy. We, Techimply will help in these aspects with the best GST software in making the GST process. Our team of well-trained professionals will be available for you at the time that you need them.Best GST Software in India for every business

Best GST Software in India 2023 in following states

Best GST Software in India 2023 in following industries

- Education

- Finance

- Real Estate

- Healthcare

- Media

- Non Profit

- Agriculture

- Auto Dealership

- Banking

- Consulting

- Distribution

- Food / Beverage

- Hospitality

- Insurance

- Retail

- Accounting

- Advertising

- Pharmaceuticals

- Software & Technology

- Transportation

- IT

- Construction

- Property Management

- Telecommunications

- Utilities

- Textile

- Hotel & Restaurant

- Service

0.0

0.0

_mid.png)