GoormIDE is a powerful cloud Integrated Development Atmosphere (IDE) that aids programmers and teams in optimizing efficiency. At goormIDE, programmers can quickly and quickly use various GPU sources, including NVIDIA,...

View ProfileTop Online Banking Software in India - Get Free Trial

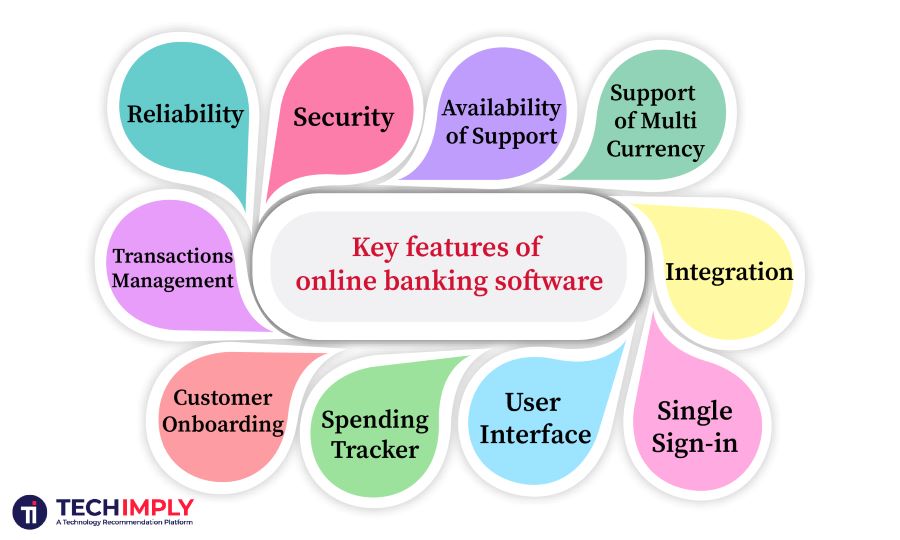

Are you looking for Online Banking Software for your Business in India? Techimply brings you the best Online Banking Software to ease your worries. In order to make your work smooth and swift, Techimply has compiled a list of the best software available. Compare the Best software features, pricing, free demo, and trial to select the best Online Banking Software for your organization.

List of Top Online Banking Software in India

Tiger is an online peer-to-peer rental industry development platform for organizations about equipment, apparel, residential property service, books, traveling, and more. A specialized control panel featured in the same comes...

View ProfileKalansh One

Kalansh is a full-featured banking and finance solution created to improve and streamline financial processes.

Kalansh is a full-featured banking and finance solution created to improve and streamline financial processes. Pigmy agents can quickly and accurately collect cash from consumers using a mobile device with...

View ProfileRNDpoint's Neobank software offers customizable UI, integrations, and a unique backend core to launch your own digital bank.

View ProfileCheck How ENGAGE Commerce can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Telepin Mobile Money can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Csmart Bank can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How MFS PLATFORM can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How SNS System Cooperative Society Software can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Simbuka can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How BnC (Bank On Cloud) can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Spotbanc can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Prometeo can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How fidorOS can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Acorns can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Metaprise can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Finaple can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Swan can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Bilderlings can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileCheck How Tietoevry Banking can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View Profile

0.0

0.0

.png)