FreshBooks is a time-saving, automated online accounting and invoicing tool that keeps your books organized and makes your company seem professional. According to FreshBooks, financial recordkeeping should be quick and...

View ProfileBest Fixed Asset Accounting Software in 2024 | Techimply

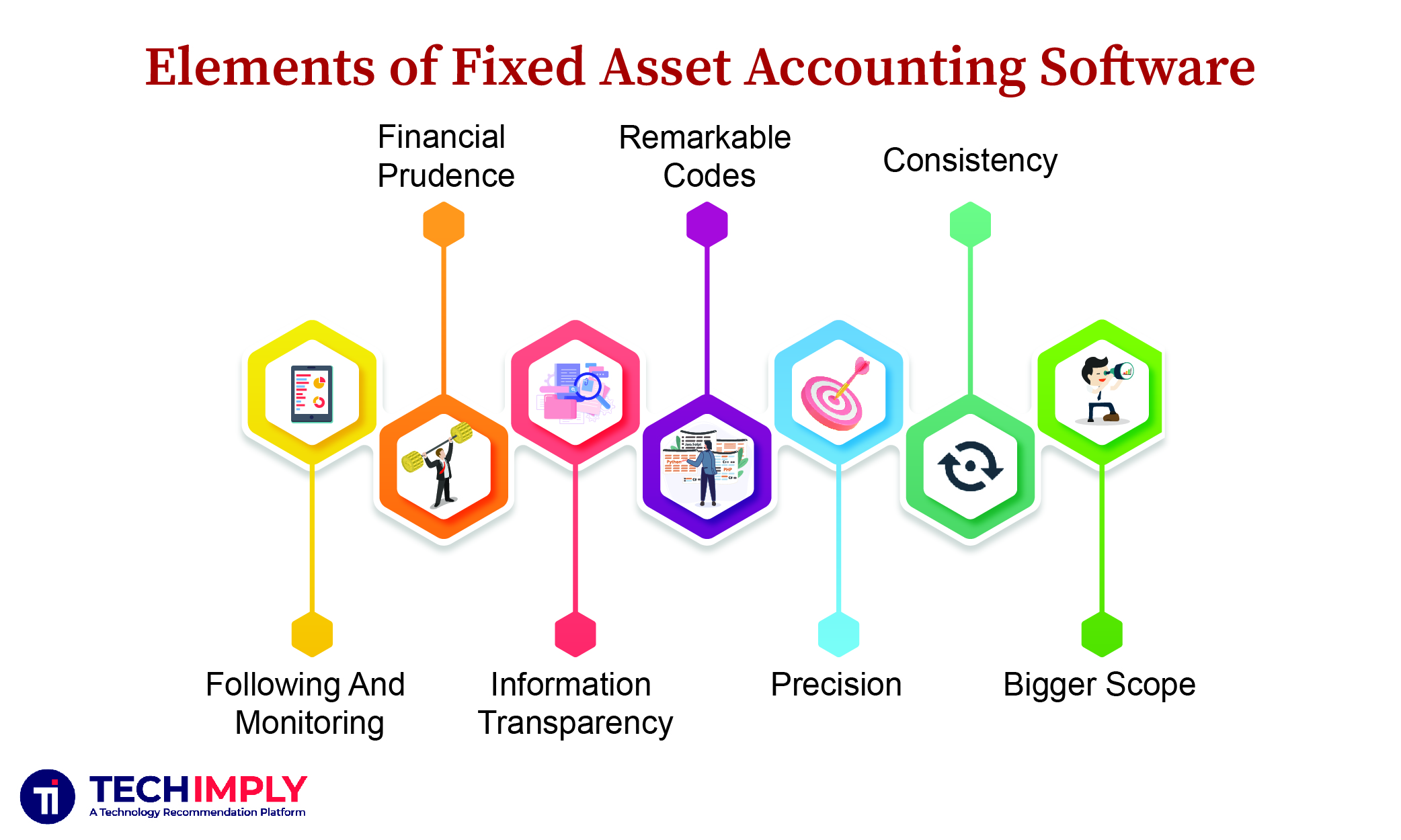

Are you searching for a first-rate fixed asset accounting software for enhancing the overall performance of your enterprises? Now you are standing on the right page and go through this article for further details about the fixed asset accounting. The term fixed assets are appraised as the long-term tangible assets used for improving the productivity range of the organizations. This software integrated with different kinds of features for managing the fixed assets of all enterprises. We, TechImply can offer advanced and top-notch features software for promoting your convenience level. Therefore, the companies who are all seeking for the right software have to utilize these opportunities.

List of 20 best Fixed Asset Accounting Software | Get Free Demo Now

Oracle Cloud Infrastructure gives better overall performance, protection, and value savings. It is designed so businesses can flow workloads easily from on-premises structures to the cloud, and among cloud and...

View ProfileCheck How HoneyBook can help to automate Indian Business. Techimply provide their list of features, pricing, Free demo and Comparison with the best alternative

View ProfileAssign assets to custodians, employees, locations, branches , projects, departments and cost-centers to enforce accountability. Manage repair requests to get equipment back & running to reduce downtime. Extend the life of...

View ProfileTally.ERP 9 is one of India’s leading business management software for GST, accounting, inventory, and payroll. It is economical and one of the most popular ERP software solutions available in...

View ProfileHDPOS is the best accounting software. HDPOS smart and great billing and invoice management software. HDPOS is very easy billing software system because its to add item to the sales...

View ProfileAcme Insight Easy to use Desktop based software, Acme's Insight Billing software helps a retailer to handle multiple customers. Dedicatedly Developed for the Traders, Manufacturers, Dealers, and Retailers by considering...

View ProfileMarg is the most suggested and powerful GST Ready Accounting Software for Small-scale and medium businesses that can manage account payables and receivables hassle-free.

View ProfileProfitBooks is the fastest growing & simple to access online accounting software. You can easily track your transactions and control your bank account details. It keeps tabs on your business...

View ProfileBusy accounting software is simple and easy to provide billing and invoice software. Busy is simple accounting software that has everything you need to grow up your business.

View ProfileHDPOS is one of the best accounting software. It is easy to use and has a nice interface. It is a Windows-based Billing, Inventory Management and Accounting Software and it...

View ProfileProfitBooks is a simple and fastest business accounting software for small businesses. It lets you create beautiful invoices, track expenses and manage inventory without any accounting background.

View ProfileOur Expertise in the wide range of business applications in Multi-Tier distribution Architecture and Mobile device provided innovatively and quality IT products and solution to help implementation of the agile,...

View ProfileAn integrated SaaS-based business management software that works with different departments and ensures productivity and employee responsibility, accounting and finance.

View ProfileThe Best Standalone Indirect taxation solution is one of the Best branches of CAMS-Exact software solution. We have been providing these solutions since 2 decades, which led to our evaluation...

View ProfileSpine Technologies stands as a distinguished leader, exuding 20+ years of seasoned expertise in the realm of human resource management. It is renowned for its unshakeable reliability, affordability, and holistic...

View ProfileThe TFAT ERP system is a collection of tools, highly advanced business functional tools, to which many other modules can be attached or extended. It has several components (mandatory and optional), which...

View Profile

Restaurant/ Cafe POS Software

Don't be panic about your Restaurant/FastFood Business, You take the orders and relieve.

Don't be panic about your Restaurant/FastFood Business, You take the orders and relieve. Alpha Extreme ERP software manages your whole system from up to end.

View ProfileThe nTireCAMS- Asset Management Software is a Computerized Maintenance Management Software, which is a100% web based operation software.

View ProfileDeskera is best for Growing businesses or startups looking for an affordable tool to manage accounting, inventory, order fulfillment, invoicing, billing, online payments, bank connections, and multiple integrations.

View Profile

Frequently Asked Questions (FAQs)

Fixed Asset Accounting Software is a tool designed to help organizations manage, track, and account for their fixed assets over their entire lifecycle. Fixed assets include items like property, equipment, vehicles, and machinery.

Fixed Asset Accounting Software streamlines asset management, automates depreciation calculations, enhances accuracy in financial reporting, ensures compliance with regulations, and helps with asset optimization.

The software automates the calculation of depreciation expenses, which is critical for accurate financial reporting and tax compliance. It supports different depreciation methods and schedules.

Yes, many software solutions offer features to track asset locations, maintenance history, warranty information, and schedules for routine maintenance tasks.

Yes, Fixed Asset Accounting Software often integrates with general ledger and accounting systems to ensure consistency between asset records and financial statements.

The software maintains an accurate record of asset values and transactions, which is crucial for compliance with accounting standards and for providing auditors with necessary information.

0.0

0.0

_mid.png)

_mid.jpg)